Is your 2026 revenue already at risk because of a holiday that hasn’t happened yet? Chinese New Year is the single biggest disruptor in global supply chain management 1{#ref-1}, and for glassware buyers, a late order means empty shelves for months. If you don’t act now, your competitors will secure the last available shipping containers.

To avoid stockouts during Chinese New Year 2026, which begins on February 17, you must place your final orders no later than November 15, 2025. While glass furnaces remain operational to prevent structural damage, production output drops by 70% as the skilled workforce departs, effectively halting downstream processing for three to four weeks. We recommend maintaining a buffer stock of 30% to 40% above standard requirements to cover this gap and the post-holiday ramp-up period.

Managing a supply chain from our production base in Zibo has taught us that the “CNY effect” is predictable but unforgiving. Every year, we see buyers like Jacky struggle because they assume that since the furnace is “on,” the products will keep flowing. This guide provides the technical timeline and strategic buffers you need to survive the Year of the Horse.

When is the absolute latest date to place orders before Chinese New Year?

In our experience, the most dangerous word in procurement is “tomorrow.” In the glass industry, we don’t just “turn on” a machine; we manage complex thermal processes that require weeks of planning. If you wait until December to think about February, you’ve already lost the battle for capacity.

The absolute latest date to place orders for CNY 2026 is November 15, 2025. This allows for a standard 45-to-60-day production cycle plus two weeks of transit to the port before the national shutdown begins on February 17. Any orders placed after this “red line” run a high risk of being pushed to late March or April, as factories prioritize long-standing strategic partners for the final pre-holiday production slots.

The Critical Path to the Feb 17 Deadline

At our facility, our production planners begin “locking” the January schedule as early as October. We batch production based on glass type—vidrio borosilicato 2{#ref-2} vs. vaso de sosa-lima 3{#ref-3}—and mold specifications. If your order doesn’t fit into a pre-CNY batch, it remains in the queue until the workforce returns in March.

November 15th is the deadline because it accounts for the logistics squeeze. As Chinese New Year 2026 4{#ref-4} approaches, trucking costs in China can double, and port congestion at the Port of Qingdao 5{#ref-5} becomes extreme. By having your goods ready for shipment by late January, you avoid the frantic scramble for container space.

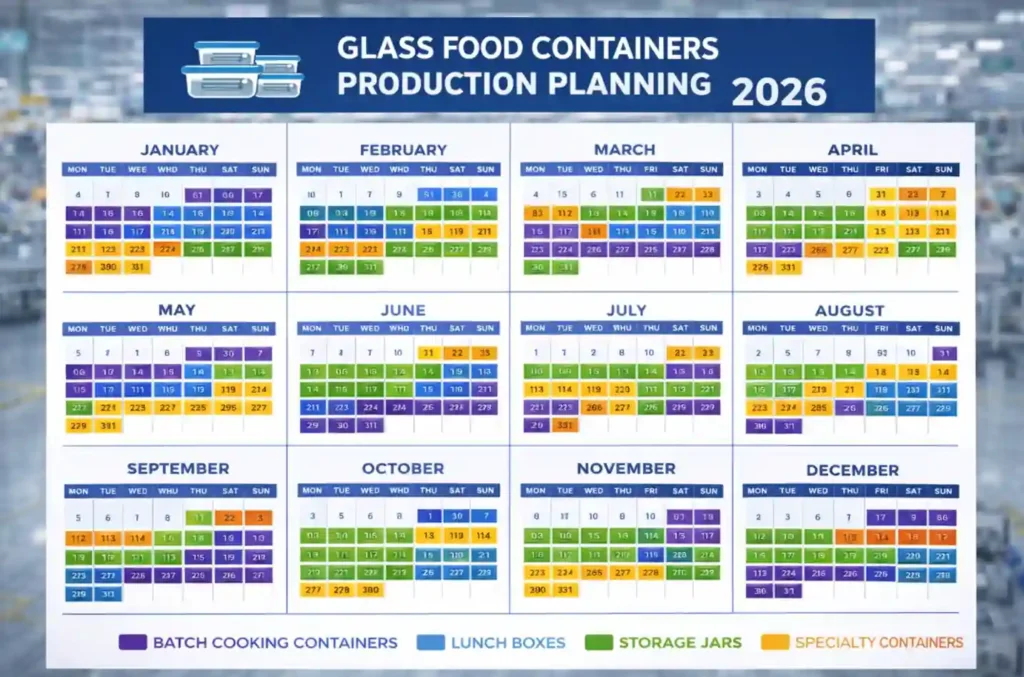

Order Deadline Calendar for CNY 2026

| Milestone | Target Date | Status | Impact on Your Inventory |

|---|---|---|---|

| Initial Forecasting | Sept 15, 2025 | Recommended | Aligning your sales data with our raw material prep |

| Final PO & Deposit | Nov 15, 2025 | Crítica | Last chance to secure a spot in the pre-CNY run |

| Material Procurement | Dec 1, 2025 | Production | Factory secures glass cullet and specialized packaging |

| Mass Production | Dec – Jan | Production | High-intensity manufacturing before workers depart |

| Last Ship Date | Jan 25, 2026 | Logística | Goods must clear customs before port staff go on leave |

| CNY Shutdown | Feb 17, 2026 | Halt | All production and logistics in China stop completely |

The “Ghost Period” of Late January

Many buyers assume that since the holiday starts on February 17, they have until early February to ship. In the glass industry, many of our skilled workers leave 10 to 14 days before the official holiday to beat the Chunyun travel rush 6{#ref-6}. This means our capacity drops significantly by February 1st. By the time the government holiday officially starts, the factory is already a “ghost town.”

How long do glass factories actually close during the CNY holiday?

One of the most common misconceptions we hear from international buyers is that CNY is a one-week holiday. While the government-mandated break is indeed seven days, the reality on the factory floor in Zibo is much longer.

Glass factories actually close for two to four weeks during the CNY holiday period. While the official public holiday for 2026 is February 17–23, workers begin departing as early as February 5 and often do not return in full force until after the Lantern Festival on March 3. This creates a total production halt of at least 21 days, followed by a two-week “ramp-up” period as production lines are recalibrated and new workers are trained.

The Reality of Furnace “Idle Heat” and 70% Output Reduction

In the glass industry, the furnace is the heart of the factory. Our engineers keep the furnaces running 24/7, even during the peak of Chinese New Year. However, just because the furnace is “on” doesn’t mean we are producing your glassware. While the molten glass remains hot, the downstream labor—the people who operate the blowing machines and the packing teams—all go home.

As a result, our total factory output drops by at least 70% during this period. We maintain just enough “skeleton staff” to monitor the furnace temperature. For you, the buyer, this means that even though the factory isn’t technically “closed” in a thermal sense, the manufacturing of finished goods is effectively dead.

How do I avoid the quality issues common in the pre-holiday production rush?

The three weeks leading up to CNY are the most dangerous time for product quality. As factories push for maximum output to clear backlogs, the risk of “corner-cutting” increases. In the glass world, this can manifest as a poor annealing process 7{#ref-7}, uneven wall thickness, or sloppy packaging.

To avoid pre-CNY quality issues, you must implement a strict “No Rush” production policy by finalizing designs months in advance and scheduling your final third-party inspection at least 15 days before the last ship date. Avoid making last-minute design changes in December, as the factory floor is too chaotic to implement them reliably, and prioritize suppliers who maintain a consistent, year-round workforce rather than relying on seasonal labor to meet the holiday surge.

The Psychology of the Holiday Rush

To mitigate risks, we increase the frequency of our internal stress tests during December and January. We also advise our clients to consider hiring a third-party inspection agency 8{#ref-8}. The key is to schedule this inspection early. If you wait until the week before the holiday and the goods fail, there is no time for the factory to rework the products.

| Defect Type | Likely Cause in Rush | Risk to Buyer |

|---|---|---|

| Thermal Stress | Shortened annealing time | Spontaneous breakage in transit or use |

| Wall Thinning | Poor air pressure control | High fragility and safety hazards |

| Surface Scratches | Rough handling during fast packing | Poor aesthetic and retail complaints |

| Packaging Failure | Using lower-grade cardboard | Massive breakage during ocean freight |

At PYGLASS, we ensure all pre-CNY batches strictly adhere to AQL standards 9{#ref-9} to maintain our reputation for reliability.

What buffer stock should I hold to cover the 4-6 week production gap?

Calculating your inventory management 10{#ref-10} strategy for CNY is not just about counting the days the factory is closed. You must also account for the logistics lag and potential shipping delays.

To cover the CNY gap, you should hold a buffer stock equivalent to 10 to 12 weeks of your average sales volume. This covers the four-week factory shutdown, a two-week ramp-up period, and a four-to-six-week shipping and customs clearance window. For a purchasing manager in Canada, this means ensuring your warehouse is fully stocked by late January to carry you through until the first post-holiday shipments arrive in mid-April.

The Math of the CNY Production Gap

If the factory effectively halts output on February 10, the first new production will likely ship in the second week of March. With a 35-day ocean voyage and 7 days for customs, that shipment won’t reach your warehouse until late April. If you only had one month of stock in February, you would be out of stock for eight weeks.

| Component | Time Period | Reasoning |

|---|---|---|

| Standard Sales Coverage | 4 Weeks (Feb) | Factory output is down 70%; no new goods leaving China |

| Post-Holiday Ramp-up | 2 Weeks (Mar) | Factory is at 50% capacity; delays in production |

| Transit & Clearance | 6 Weeks | Time from factory gate in Zibo to your warehouse |

| Total Inventory Needed | 12-14 Weeks | Total coverage required to avoid Q1/Q2 stockouts |

Conclusión

The 2026 Chinese New Year is a predictable event, yet every year it catches thousands of buyers off guard. By placing your orders by November 15, understanding that output effectively drops by 70% for a full month, prioritizing quality over speed, and maintaining a robust 14-week inventory buffer, you can navigate this disruption with ease. At PYGLASS, we are committed to helping our partners achieve “Safer, Healthier, Greener” growth.

Notas a pie de página

1. Definition of supply chain management and its role in coordinating global trade. ↩︎

2. Technical properties and chemical composition of high-durability borosilicate glass materials. ↩︎

3. Overview of soda-lime glass, the most common type of glass for consumer goods. ↩︎

4. Official holiday dates and traditional calendar for Chinese New Year 2026. ↩︎

5. Resource for port operations and shipping schedules at the Port of Qingdao. ↩︎

6. Analysis of the massive annual travel migration in China during the Spring Festival. ↩︎

7. Scientific explanation of the annealing process used to stabilize manufactured glass. ↩︎

8. Global leader in inspection, verification, and testing services for international manufacturing. ↩︎

9. Detailed guide to Acceptable Quality Level (AQL) standards for industrial inspections. ↩︎

10. Strategic approach to optimizing stock levels and managing supply chain inventory effectively. ↩︎