Constant quality defects and missed deadlines from your current glass supplier are hurting your brand. You know you need to switch, but the fear of a total supply chain collapse 1{#ref-1} stops you. Don’t let a bad partner hold your growth hostage anymore.

Smoothly switching to glassware manufacturers China like PYGLASS requires a 2-to-6-month phased transition. Build an 8-to-12-week safety stock, settle IP and tooling rights with your old vendor, and run a pilot order. This ensures continuous supply while upgrading to superior borosilicate quality and more reliable manufacturing standards.

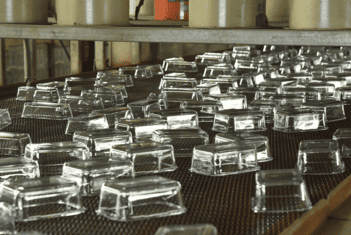

Making the move to a top-tier factory isn’t just about changing an address; it’s about upgrading your entire standard of excellence. At our 200,000㎡ facility in Zibo, we have helped dozens of global brands manage this delicate shift without a single day of out-of-stock. This guide will walk you through the technical and strategic roadmap for a zero-downtime transition to a better class of manufacturing.

How do I transfer my existing molds from an old factory to a new one?

Your custom molds are expensive assets, but moving them to a new factory often reveals hidden technical mismatches. If the molds don’t fit the new machinery, your production stops dead and your investment is wasted.

To transfer molds, first audit their physical condition and compatibility with the new factory’s machine specifications. Many top glassware manufacturers prefer re-tooling to ensure precision. If moving, document all maintenance logs and ensure your NNN agreement clearly establishes your legal ownership of the physical steel tooling before notifying the incumbent supplier.

The Reality of Tooling Portability

In our 15 years of operation, we have found that “universal” molds are a myth. Every glass-forming machine has specific machine specifications 2{#ref-2} for clamping pressure, cooling air intake, and neck-ring alignment. When a new client asks us to take over existing molds, our engineering team starts with a “Legacy Tooling Audit.” We check the steel grade, the wear on the parting lines, and the compatibility of the mold base with our automated lines.

Before you even mention the word “transfer” to your old supplier, you must verify your legal rights. We have seen cases where old factories hold molds “hostage” over unpaid “maintenance fees” or disputed IP. Ensure your NNN agreement 3{#ref-3} clearly establishes your legal ownership of the physical steel tooling before notifying the incumbent supplier.

Comparison: Moving Existing Molds vs. New Tooling

| Factor | Moving Existing Molds | Investing in New Tooling |

|---|---|---|

| Upfront Cost | Low (Freight + Modification) | High ($1,500 – $5,000 per size) |

| Compatibility | High Risk of Machine Downtime | 100% Optimized for Factory |

| Product Quality | Varies based on mold wear | Superior (Clean edges, no seams) |

| Plazos de entrega | 2-3 weeks for modification | 30-45 days for fabrication |

| Long-term Value | Lower due to inevitable aging | Higher (Includes latest engineering) |

What risks should I manage when switching glass suppliers mid-production?

Switching suppliers during a live production cycle 4{#ref-4} is like changing tires while the car is moving. One wrong move results in stockouts, legal battles, or catastrophic quality drops that can ruin your retail reputation.

Manage transition risks by securing a ‘Legacy Gap Analysis’ where the new factory identifies and fixes recurring defects from the old supplier. Build a safety stock buffer of 12 weeks to cover the 2-to-6-month ramp-up period and perform third-party audits on the first three batches from the new factory to ensure total quality consistency.

Managing the Quality “Drift”

When you move from a mid-tier factory to a high-quality facility like ours, you will notice a difference in the product. While this is usually an improvement, it can lead to “quality drift” where your current stock on the shelves looks slightly different from the new shipment. This is especially critical for sets where consumers expect uniformity. Our QC team handles this by performing a side-by-side comparison. We match the clarity, the wall thickness, and even the “tint” of the vidrio borosilicato 5{#ref-5} to ensure a seamless transition.

Transition Risk Mitigation Matrix

| Risk Category | Potential Impact | Mitigation Strategy |

|---|---|---|

| Supply Chain Gap | Empty shelves / Lost sales | Build 3 months of “Safety Stock” |

| Technical Errors | Molds don’t fit machines | Pre-production CAD/CAM simulation |

| Legal Disputes | Molds held by old factory | Settle all payments before exit notice |

| Quality Inconsistency | Brand reputation damage | Multi-stage AQL inspections |

| Knowledge Loss | Specific design quirks forgotten | technical documentation 6{#ref-6} transfer |

The “Safety Stock” Insurance Policy

The biggest fear for a Purchasing Manager like Jacky is a stockout. We always advise our partners to over-order from their old supplier one last time before initiating the switch. This “Exit Order” creates a cushion. If the new factory takes longer to calibrate the colors or the annealing cycle, you are not under pressure. We suggest you perform third-party AQL inspections 7{#ref-7} on the first three batches from the new factory to ensure total quality consistency.

How can I run a pilot order to test the new factory without disrupting supply?

Jumping straight into a 40HQ container with a new supplier is a gamble that rarely pays off. If the quality is wrong or the lead times are off, you lose thousands of dollars and your reputation with retailers.

Run a pilot order by selecting your highest-volume SKU and ordering 10-20% of your usual volume from the new factory. This ‘PVT’ (Production Validation Testing) run identifies potential manufacturing bottlenecks and allows for fine-tuning of the annealing and packing processes without risking your entire quarterly stock levels.

The Production Validation Testing (PVT) Process

At our Zibo facility, we treat a pilot order as a full-scale test of our relationship, not just the glass. We monitor every stage: how quickly our sales team responds and how our engineers interpret your mood boards. This Production Validation Testing 8{#ref-8} run is large enough to be statistically significant—usually 1,000 to 2,000 units—but small enough that a total loss wouldn’t break your budget.

Once the pilot order arrives and passes your internal checks, the scaling process begins. We don’t suggest going from 2,000 units to 50,000 units overnight. Instead, we recommend a “Stepped Ramp-up.” The next order should be 50% of your volume, then 100%. This allows our production team to optimize the “batching” and energy usage of our 1,500°C electric-hybrid furnaces.

Why is it important to keep the old supplier warm during the transition period?

Burning bridges with an incumbent supplier before the new factory is fully validated is a high-risk move. If the new production fails its safety tests or the shipping lanes are blocked, you need an emergency exit.

Keeping the old supplier ‘warm’ provides a vital safety net during the 90-day integration phase. By dual-sourcing—splitting your volume between the old and new factory—you maintain a backup capacity and leverage competition to ensure both glassware manufacturers stay sharp on quality and pricing.

The Strategy of Dual Sourcing

In the volatile environment of 2026, single-sourcing is a vulnerability. We always advise our clients to maintain a standby relationship with their legacy factory for at least two quarters after switching to us. Finding reliable glassware manufacturers China 9{#ref-9} is a journey, and having a backup ensures your retail commitments are always met.

This is not “cheating” on your supplier; it is professional risk management. A strategic partner will understand that you need to protect your brand. In fact, we often work better when we know there is a benchmark for our performance. By practicing dual sourcing 10{#ref-10}, you maintain a backup capacity and leverage competition to ensure both glassware manufacturers stay sharp.

Conclusión

Switching to a higher-quality partner like PYGLASS is a strategic move that future-proofs your brand in an increasingly competitive market. By carefully managing mold transfers, building significant safety stock, running structured pilot orders, and maintaining a dual-sourcing safety net, you can navigate this complex transition with total confidence. At our 200,000㎡ manufacturing base in Zibo, we are ready to prove that the upgrade to better glass is the best decision your company will make this year. Let’s build a supply chain that reflects your commitment to excellence.

Notas a pie de página

1. Professional insights into preventing total supply chain disruptions in complex global trade. ↩︎

2. Guide to understanding technical specifications for industrial molding and manufacturing machines. ↩︎

3. Importance of Non-Disclosure, Non-Circumvention, and Non-Use agreements in international sourcing. ↩︎

4. Detailed explanation of the manufacturing production cycle and its management for startups. ↩︎

5. Scientific properties and quality standards for high-performance borosilicate glassware materials. ↩︎

6. International standards for technical product documentation and engineering specifications in manufacturing. ↩︎

7. Guide to using Acceptable Quality Level standards for industrial glassware product inspections. ↩︎

8. Methodology for validating production processes through structured testing phases for new manufacturers. ↩︎

9. Directory and information for finding reliable glass product manufacturing partners located in China. ↩︎

10. Strategic benefits of maintaining multiple suppliers to enhance overall supply chain resilience. ↩︎